Initiating coverage | Cap. Goods

September 25, 2012

Disa India

BUY

CMP

`2,678

Delisting effort to revisit

Target Price

`3,353

Disa India (Disa), an 86.5% subsidiary of Disa Holding AG, is a market leader in

Investment Period

12 Months

manufacturing modern foundry equipment with a 70% market share in India. As

Stock Info

per the June 2010 amendment of Securities Contract (Regulations) Act, all listed

Sector

Capital Goods

companies should have a minimum of 25% public shareholding by June 2013.

Market Cap (Rs cr)

404

Since the promoters’ stake in Disa is at 86.5%, we believe that the company may

Net Debt

(17)

opt for delisting rather than diluting its stake considering the company has tried

Beta

0.4

delisting in the past. If the delisting doesn’t get through, still the stock is trading at

52 Week High / Low

3,944 / 1,401

Avg. Daily Volume

483

an attractive valuation of 12.8x its CY2013E EPS, owing to the company’s

Face Value (Rs)

10

collaboration with Wheelabrator’s technologies, continuous expansion and

BSE Sensex

18,694

improving order book. We initiate coverage on the stock, with a Buy

Nifty

5,674

recommendation and a target price of `3,353.

Reuters Code

DISA.BO

Bloomberg Code

BMD IN

Potential delisting candidate: The amendment of Securities Contract Act in June

2010 mandates all listed companies to have a minimum

25% public

Shareholding Pattern (%)

shareholding by June 2013. We believe, Disa being a multinational company

Promoters

86.5

(MNC)’s subsidiary, with the global company holding an 86.5% stake, may opt

MF / Banks / Indian Fls

0.0

for delisting since it has a history of delisting effort in CY2007.

FII / NRIs / OCBs

1.1

Business scenario upbeat: Disa’s continuous capacity expansion complementing its

Indian Public / Others

12.4

improving order book would be a major growth driver. Moreover, the company’s

collaboration with Wheelabrator’s technologies would not only provide access to new

Abs. (%)

3m 1yr 3yr

target markets, but also improve profitability by reducing cost per part.

Sensex

10.7

16.5

12.0

Strong balance sheet: We expect Disa to post a modest 14.8% and 15.6% CAGR in its

Disa

4.2

80.8

62.3

revenue and profit, respectively, over CY2011-13E. Disa’s debt free position and cash

reserves indicate its strength in situation of worsening economic environment. At the

current market price of `2,678, the stock is trading at a PE of 12.8x for CY2013E

earnings, which we believe is attractive for an MNC. We initiate coverage on the stock

with a target price of `3,353 based on a target PE of 16.0x for CY2013E.

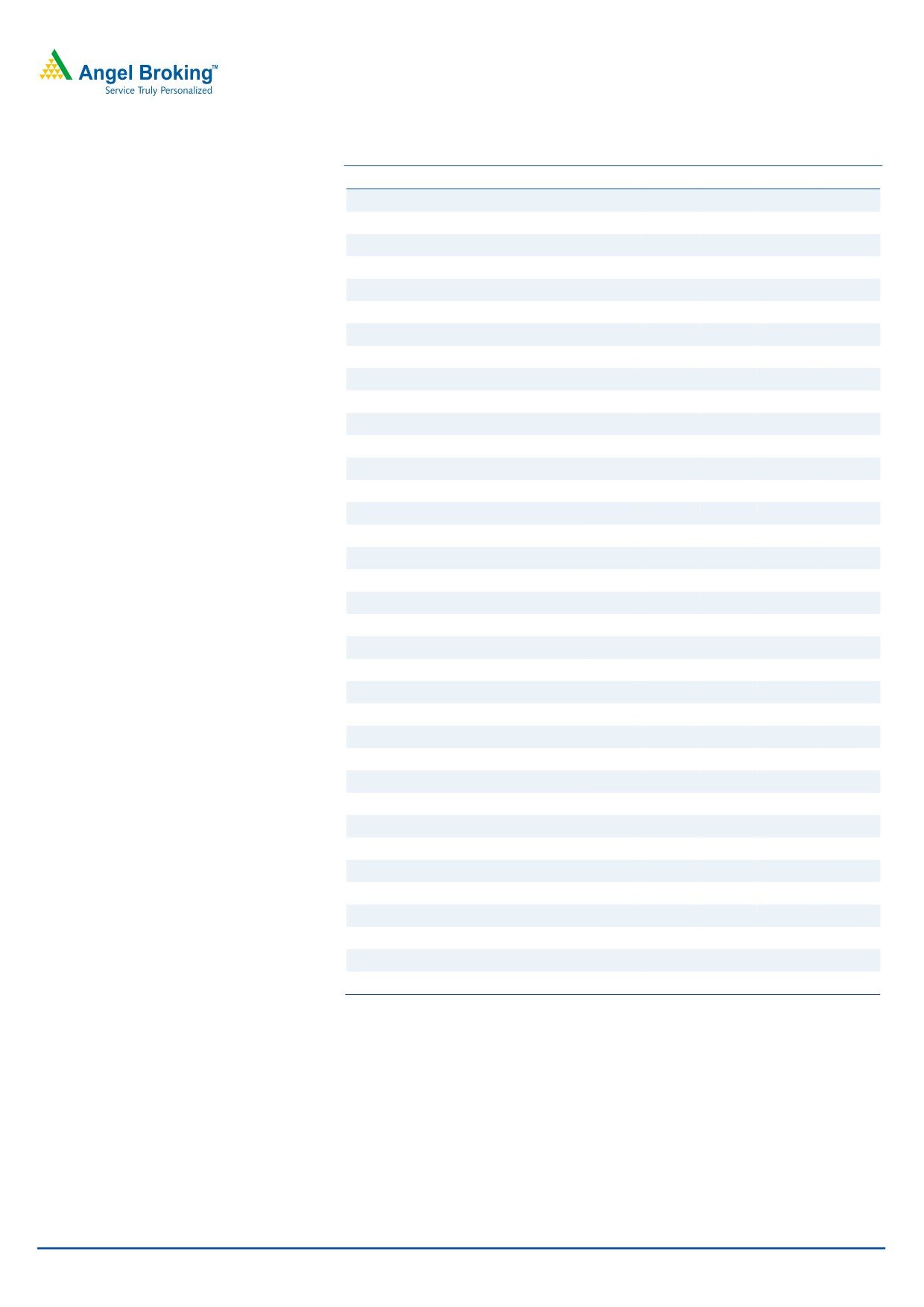

Key Financials

Y/E December (` cr)

CY2010

CY2011 CY2012E

CY2013E

Net Sales

108

154

176

203

% chg

51.0

43.1

14.6

15.0

Net Profit

15

23

28

32

% chg

14.0

14.7

15.6

15.6

EBITDA (%)

19.6

20.7

22.7

22.6

EPS (`)

100.1

150.1

182.4

209.6

P/E (x)

26.8

17.8

14.7

12.8

P/BV (x)

7.3

9.4

7.6

6.0

RoE (%)

27.1

52.5

51.8

47.0

RoCE (%)

39.8

59.8

75.6

69.5

Shareen Batatawala

EV/Sales (x)

3.3

2.2

2.0

1.7

+91-22-3935 7800 Ext: 6849

EV/EBITDA (x)

17.0

10.8

9.0

7.5

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Initiating coverage | Disa India

Investment Rationale

Potential delisting candidate

In June 2010, the government amended the Securities Contract (Regulations) Act

Historical delisting effort to revisit

rules, according to which all listed companies should have a minimum of 25%

public shareholding by June 2013.

The promoters (Disa Holding A/S) had made a delisting offer in April 2007 to

acquire up to 3,88,554 shares representing 25.73% stake in the company. The

delisting offer was rejected by the management due to high discovered price of

`2,960 per share.

In December 2008, Hamlet Holding II ApS along with Disa Holding II A/S, Disa

Holding A/S and DISA Holding AG, announced an open offer for acquisition of

upto 3,02,041 shares representing 20% of the paid-up equity share capital of Disa

India at a price of `1,657 per share. 1,84,485 shares were acquired in the offer

representing 12.22% of the total share capital amounting to `30.6cr. These shares

were held in the escrow account since the Securities and Exchange Board of India

(SEBI) contested the open offer price calculation. SEBI lost the case in Securities

Appellate Tribunal (SAT) and appealed to the Supreme Court. The Supreme Court

gave Disa’s promoters permission to transfer the shares even though the case is

still going on, since the company gave an undertaking to abide by the Supreme

Court’s decision, whatever it might be. The promoters now officially hold 86.5%.

Hence, in order to comply with the amended Securities Contract (Regulations) Act

the company may opt for delisting rather than diluting its stake.

Business scenario upbeat

Continuous expansion, improving order

Disa has been continuously expanding its manufacturing facilities at Tumkur and

inflow and Wheelabrator collaboration-

Hosakote plants. The company is now planning its third unit near Bangalore. We

indicators of improving business

expect these expansion plans to facilitate revenue growth going forward.

scenario

Moreover, improving order intake which has more than doubled over CY2008-11

from `70cr in CY2008 to `150 in CY2011, would monetize in future.

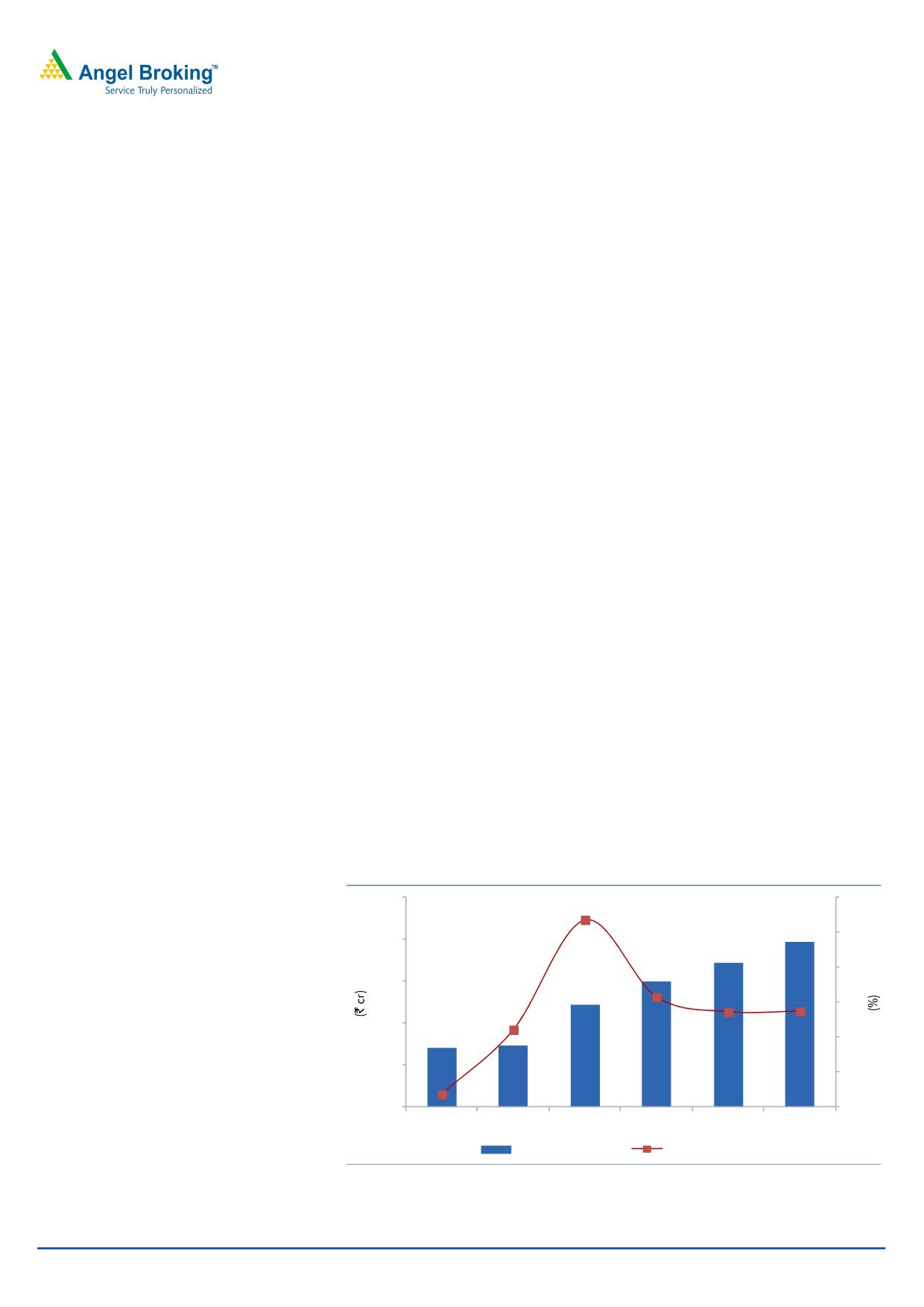

Exhibit 1: Order intake

250

80

67.1

60

200

40

150

23.0

14.5

20

14.8

100

4.3

0

50

(20)

70

(32.7)

73

122

150

172

197

0

(40)

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

Order intake (LHS)

yoy growth (RHS)

Source: Company, Angel Research

September 25, 2012

2

Initiating coverage | Disa India

With the global merger of Wheelabrator group with Disa group in CY2009, Disa

would now get access to Wheelabrator’s surface preparation technology leading to

focus on new target markets, ie automotive and steel processing industries. The

automotive industry accounts for ~30% of the Indian foundry industry, thus

facilitating the company’s revenue growth. Moreover, a blend of the two

technologies would result in lower cost per part for the company, thus resulting in

better profitability.

Strong balance sheet will aid long term sustainability

Debt free position to shield against

Disa is a debt free company with cash reserves of `60cr for CY2011 and ROCE

economic instability

and ROE of 59.8% and 52.5% respectively. Thus, the interest rate volatility would

not have any direct impact on the company. In view of the recent economic

instability, the company’s strategy of being cash rich could serve as a savior if the

economy weakens further.

Financials

Exhibit 2: Key Assumptions

(%)

CY2012E

CY2013E

Growth in Foundry business

14.5

14.8

Growth in Air business

15.0

16.0

Source: Angel Research

Capacity expansion & better order intake to support revenue

growth

We expect the company to post a CAGR of 14.8% over CY2011-13E in its revenue

inspite of a decline in investment cycle. This growth would primarily be led by

improving order intake which witnessed a 28.9% CAGR over CY2008-11 and is

expected to grow at 14.6% over CY2011-13E. Moreover, continuous expansion

projects undertaken by the company would support growth.

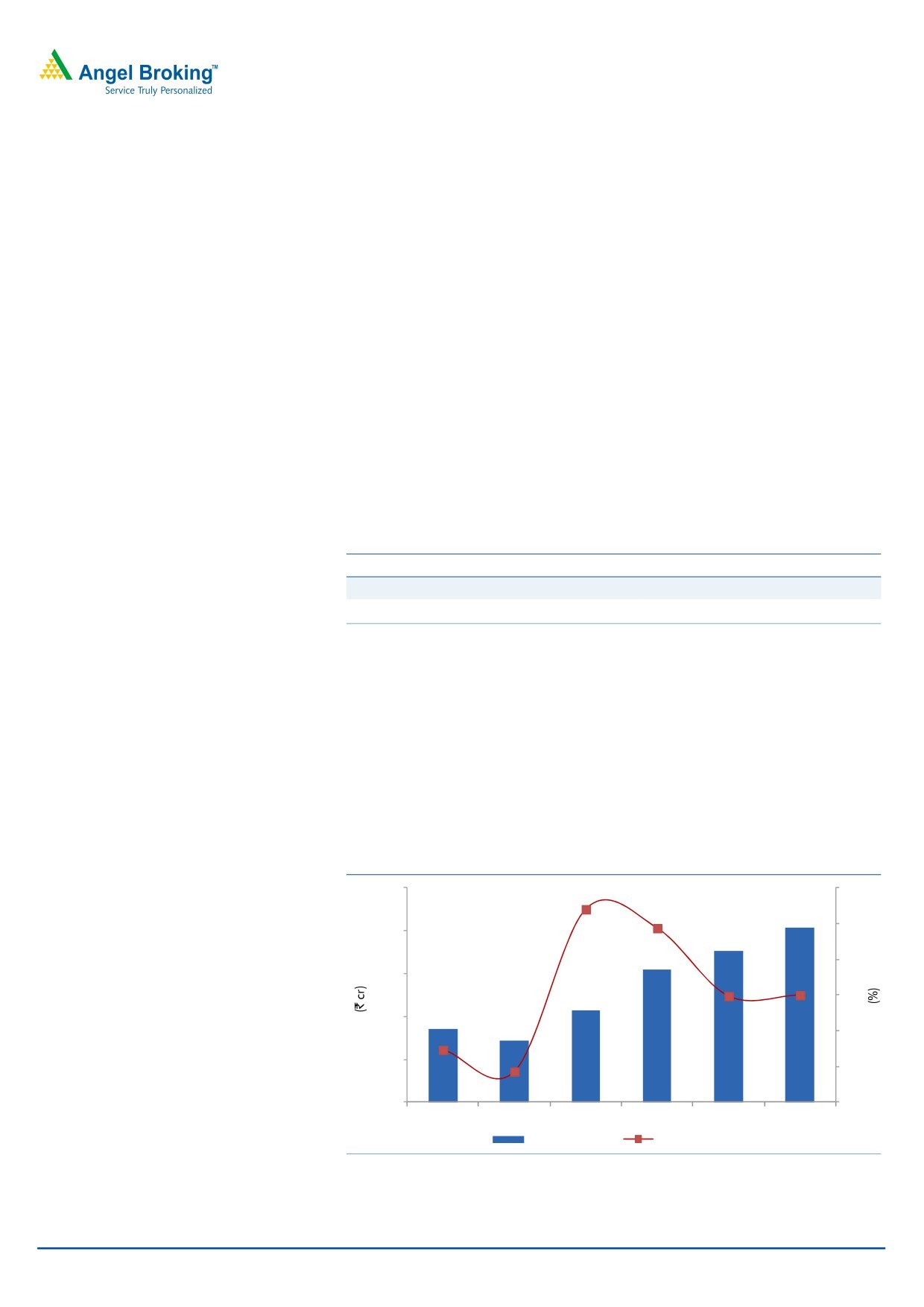

Exhibit 3: Revenue to witness a stable growth

250

60

51.0

45

200

43.1

30

150

14.6

15

15.0

100

0

(8.0)

50

(15)

(17.0)

86

71

108

154

176

203

0

(30)

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

Revenue (LHS)

Revenue growth (RHS)

Source: Company, Angel Research

September 25, 2012

3

Initiating coverage | Disa India

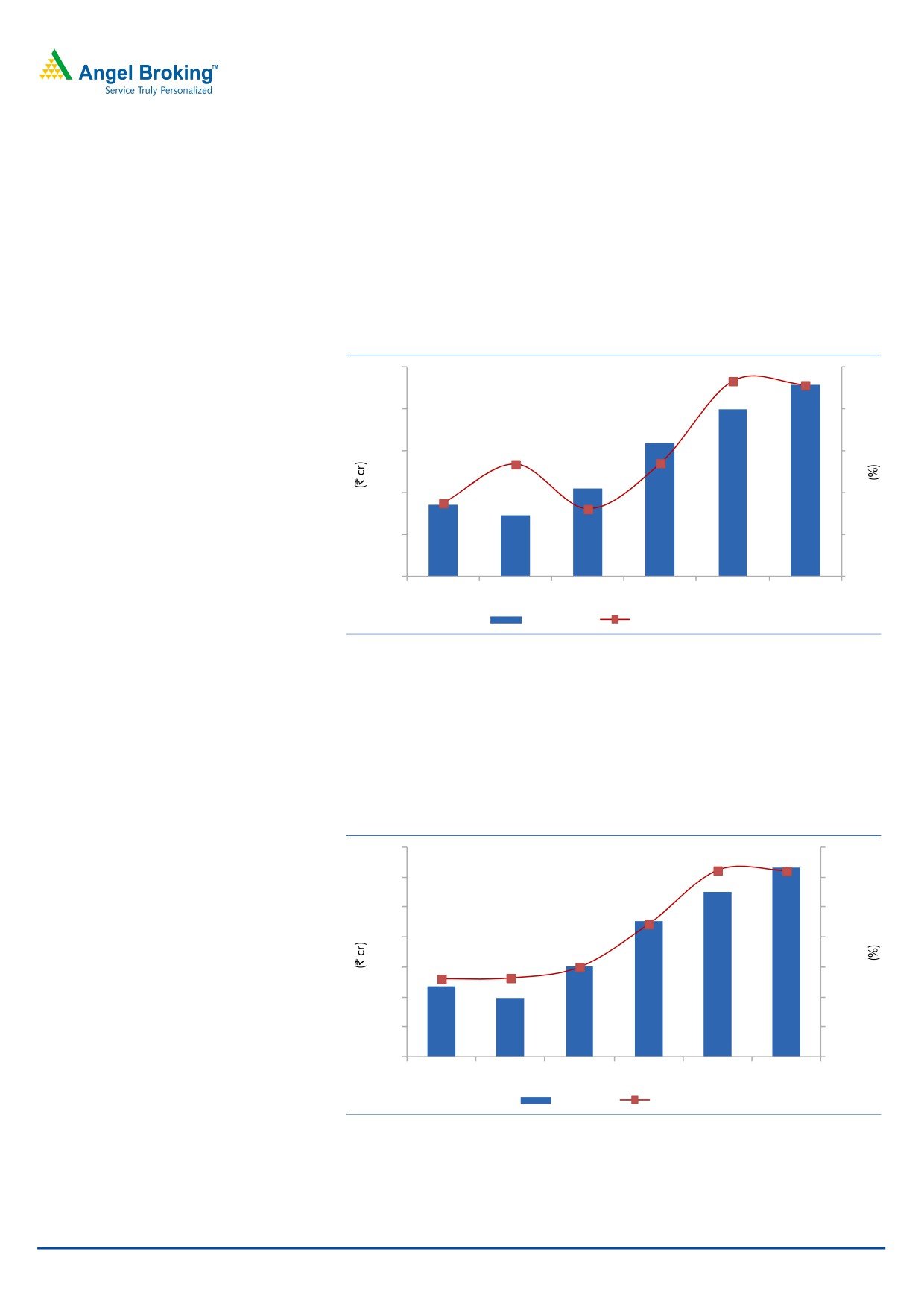

Technology collaboration benefits EBITDA margin

Disa reported relatively better EBITDA margin for 1HCY2012 as compared to

previous year on account of decline in net raw material cost as percentage of

sales. This was due to benefits arising from collaboration with Wheelabrator’s

surface preparation technology. We expect the trend to continue going forward;

we expect the EBITDA margin to expand by 187bp yoy to 22.7% in CY2012E. The

EBITDA margin is expected to stabilize at similar levels going forward.

Exhibit 4: EBITDA margin to stabilize at higher levels

50

22.7

23

22.6

40

22

20.7

20.7

30

21

19.7

19.6

20

20

10

19

17

15

21

32

40

46

0

18

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

EBITDA (LHS)

EBITDA margin (RHS)

Source: Company, Angel Research

Net profit on an uptrend

Modest revenue growth and improving EBITDA margin is expected to lead to better

profit going forward. We expect the company to post an 18.2% CAGR in net profit

over CY2011-13E to `32cr in CY2013E.

Exhibit 5: PAT margin to inch higher

35

16.0

15.6

15.6

30

15.5

25

14.7

15.0

20

14.5

14.0

15

13.8

13.8

14.0

10

13.5

5

13.0

12

10

15

23

28

32

0

12.5

CY2008

CY2009

CY2010

CY2011

CY2012E CY2013E

PAT (LHS)

PAT margin (RHS)

Source: Company, Angel Research

September 25, 2012

4

Initiating coverage | Disa India

Outlook and Valuation

Disa has posted a stupendous performance on the top-line and bottom-line front

over CY2009-11 with a CAGR of 47.0% and 51.6% in revenue and profit,

respectively. We expect the growth to be modest at 14.8% CAGR over CY2011-

13E to `203cr due to a slowdown in the investment cycle. However, the EBITDA

margin is expected to expand by 186bp over CY2011-13E owing to benefits

arising from the collaboration with Wheelabrator’s technology. Thus, the net profit

is expected to grow at 18.2% CAGR over CY2011-13E to `32cr in CY2013E.

Moreover, higher promoter stake in the company at 86.5% makes it a potential

delisting candidate to ensure compliance with the amended Securities Contract

(Regulations) Act, which mandates a minimum of 25% public shareholding by June

2013. The stock is currently trading at a PE of 12.8x it CY2013E earnings and P/B

of 6.0x for CY2013E. We initiate coverage on Disa with a Buy rating and target

price of `3,353 based on a target PE of 16.0x for CY2013E.

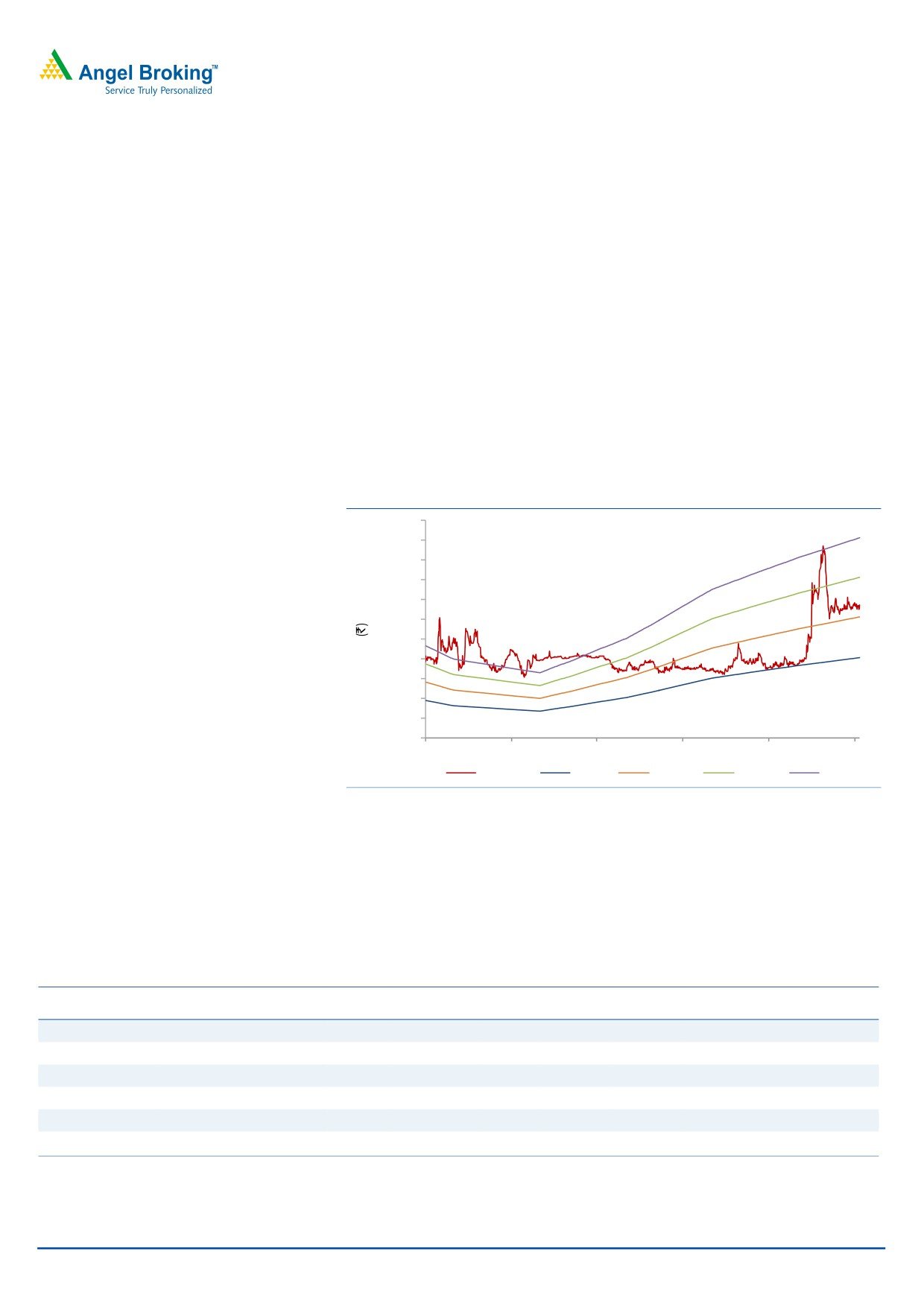

Exhibit 6: One-year forward PE band

4,400

4,000

3,600

3,200

2,800

2,400

2,000

1,600

1,200

800

400

0

Sep-07

Sep-08

Sep-09

Sep-10

Sep-11

Sep-12

Price

8x

12x

16x

20x

Source: Company, Angel Research

Relative Valuation

Amongst MNC capital goods players, Disa has a better operating margin and ROE

profile than most other players. However, it is trading at an expensive valuation in

terms of EV/sales, due to delisting expectations.

Exhibit 7: Relative Valuation

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Disa

158

22.0

25

162.3

51.1

16.5

8.4

11.2

2.5

Vesuvius

565

16.3

52

25.6

16.1

13.0

2.1

7.1

1.2

Esab

534

12.1

38

24.5

100.0

18.3

18.3

9.8

1.2

Honda Siel

510

9.7

34

33.5

12.8

15.4

2.0

7.9

0.8

Igarashi

284

16.8

18

9.0

14.0

8.4

1.2

4.0

0.7

GMM

202

8.2

9

6.4

9.1

15.4

1.4

6.4

0.5

Source: Company, Angel Research (Note: Above numbers are for TTM ended June 2012)

September 25, 2012

5

Initiating coverage | Disa India

Key concerns

Unstable economic scenario to impact growth prospects

In view of the current economic condition where we are witnessing declining GDP,

increasing inflation, and policy paralysis and with a wavering political scenario

underway, India’s investment cycle is undergoing a slowdown. Since the foundry

industry is directly dependent on the country’s investment cycle, failure in revival of

the economy will impact the growth of the company.

Hurdles in delisting

Preferences given to public shareholders: The special resolution, which

requires public shareholders’ approval, mandates votes cast in favour of the

proposal to be at least two times the number of votes cast against it.

Minimum number of equity shares to be acquired: As per SEBI guidelines, an

offer would be successful if post offer, the shareholding of the promoter

reaches higher of a) 90% shares of the total issued shares; or b) the aggregate

percentage of pre-offer promoter shareholding plus 50% of the offer size.

Company Background

Disa India, an 86.5% subsidiary of Disa Holding AG, is a market leader in the

manufacturing of modern foundry equipment with a market share of 70% in India.

It supplies complete foundry systems by integrating the moulding machines and

sand mixers with proper combination of sand plant equipment, surface treatment

machines, environmental control systems and conveying systems. The company

has two manufacturing plants in Karnataka, one in Hosakote and other in Tumkur.

Collaboration of Disa’s moulding technology and Wheelabrator’s surface

preparation technology in CY2011 has led to lowering of lifecycle cost per part

along with access to new target markets.

September 25, 2012

6

Initiating coverage | Disa India

Industry

The Indian foundry industry is the second largest producer of casting with a

production of ~9.1mnMT of various grades of castings as per International

standards. The various types of castings which are produced are ferrous, non

ferrous, aluminium alloy, graded cast iron, ductile iron, steel etc for application in

automobiles; railways; pumps compressors and valves; diesel engines;

cement/electrical/textile machinery; aero, sanitary pipes & fittings etc and castings

for special applications. Grey iron castings constitute ~70% of total castings

produced.

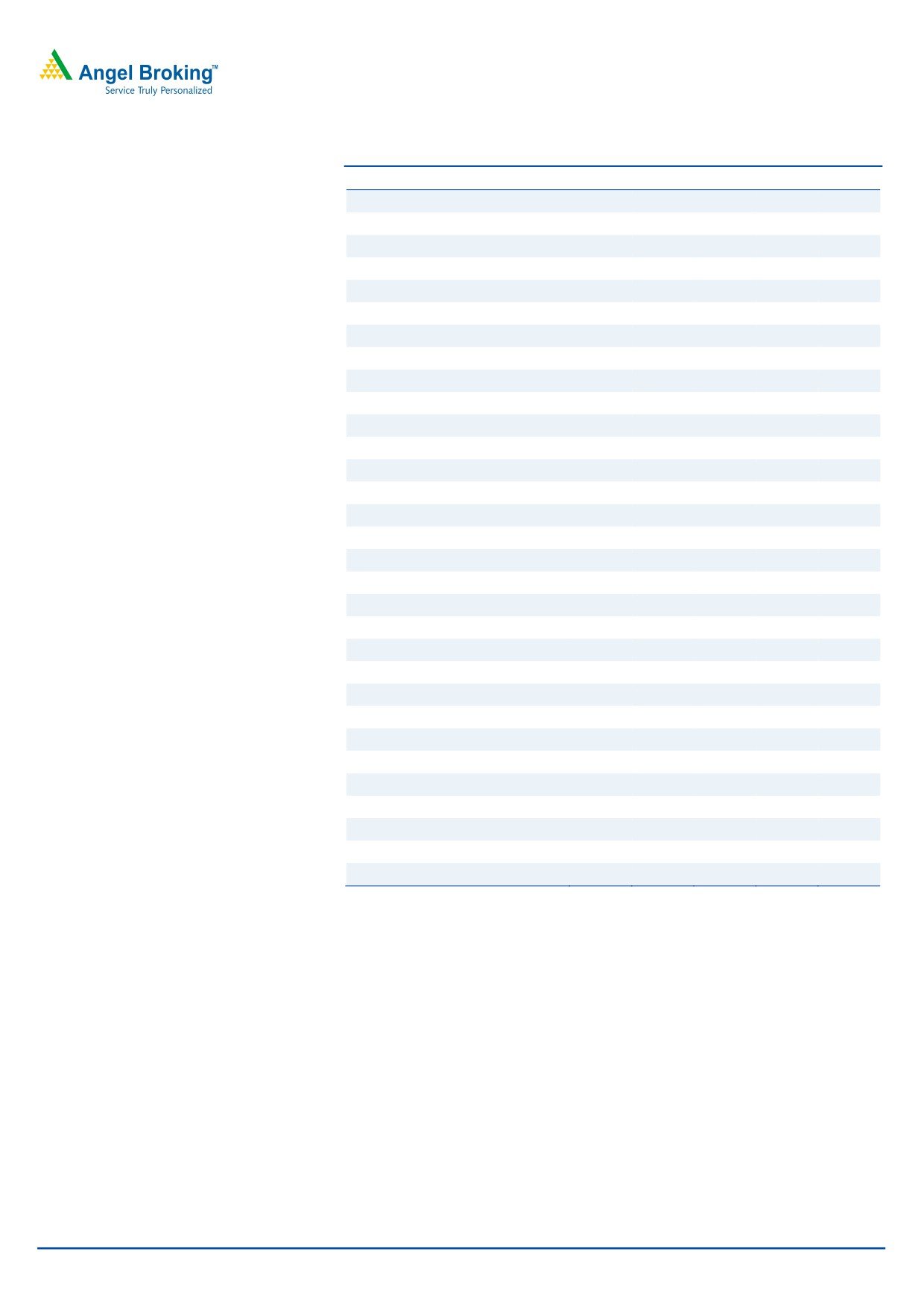

Exhibit 8: Production of castings in India

Exhibit 9: Product mix

10

40

Ductile Iron

Non Ferrous

31.2

9%

8%

30

Steel

Others

8

21

.6

18.5

12%

1%

15.1

14.4

20

6

11.1

8.2

8.8

10

1.3

4

(3.1)

0

2

(10)

(12.0)

0

(20)

Grey Iron

Production (LHS)

yoy growth (RHS)

70%

Source: Foundry informatics centre, Angel Research

Source: Foundry informatics centre, Angel Research

There are more than 5,000 foundry units in India. The majority (nearly 80%) of the

foundry units in India fall under the category of small-scale industry. The foundry

industry in India has geographical clustering; the five major clusters are in

Belgaum, Batala/Jalandhar, Coimbatore, Kolhapur and Rajkot.

September 25, 2012

7

Initiating coverage | Disa India

Profit & Loss Statement

Y/E December (` cr)

CY2009

CY2010

CY2011

CY2012E CY2013E

Gross sales

77

117

168

192

221

Less: Excise duty

5

10

14

16

18

Net Sales

71

108

154

176

203

% chg

14.3

30.1

46.0

10.8

14.4

Net Raw Materials

37

59

86

92

106

Power & Fuel costs

0

1

1

1

1

Personnel

10

13

18

22

25

Other expenses

10

14

17

22

25

Total Expenditure

57

87

122

136

157

EBITDA

15

21

32

40

46

% chg

(13.1)

43.2

51.0

25.4

14.5

(% of Net Sales)

20.7

19.6

20.7

22.7

22.6

Depreciation

2

2

2

3

4

EBIT

13

19

30

37

42

% chg

(16.5)

51.5

53.8

23.3

14.9

(% of Net Sales)

17.9

17.9

19.3

20.8

20.7

Interest & other charges

0

0

0

0

0

Other Income

3

4

5

6

7

(% of sales)

4.0

3.9

3.4

3.4

3.4

PBT

15

23

35

42

49

% chg

21.4

21.6

22.6

24.0

24.0

Tax

5

8

12

15

17

(% of PBT)

35.5

35.2

34.7

35.0

35.0

PAT (reported)

10

15

23

28

32

Extraordinary (Exp)/Inc.

0

0

0

0

0

ADJ. PAT

10

15

23

28

32

% chg

(16.9)

53.0

50.4

21.5

14.9

(% of Net Sales)

13.8

14.0

14.7

15.6

15.6

Basic EPS (`)

65.3

100.1

150.1

182.4

209.6

Fully Diluted EPS (`)

65.3

100.1

150.1

182.4

209.6

% chg

(17.6)

53.2

50.0

21.5

14.9

September 25, 2012

8

Initiating coverage | Disa India

Balance Sheet

Y/E December (` cr)

CY2009

CY2010

CY2011 CY2012E CY2013E

SOURCES OF FUNDS

Equity Share Capital

2

2

2

2

2

Reserves& Surplus

39

54

42

52

66

Shareholders Funds

40

56

43

53

67

Total Loans

1

-

-

-

-

Deferred Tax Liability (Net)

0

0

0

0

0

Total Liabilities

41

56

43

53

68

APPLICATION OF FUNDS

Gross Block

34

35

42

50

55

Less: Acc. Depreciation

21

23

25

28

32

Net Block

12

12

17

22

23

Capital Work-in-Progress

-

1

3

2

1

Investments

-

-

-

-

-

Long term Loans & adv

-

-

-

3

3

Current Assets

53

85

109

98

123

Cash

33

47

60

44

61

Loans & Advances

4

7

12

12

14

Inventory

11

18

29

29

32

Debtors

5

13

8

12

14

Other current assets

-

-

-

1

1

Current liabilities

24

42

86

72

82

Net Current Assets

29

43

23

27

40

Mis. Exp. not written off

-

-

-

-

-

Total Assets

41

56

43

53

68

September 25, 2012

9

Initiating coverage | Disa India

Cash Flow Statement

Y/E December (` cr)

CY2009

CY2010

CY2011 CY2012E CY2013E

Profit before tax

15

23

35

42

49

Depreciation

2

2

2

3

4

Change in Working Capital

5

(0)

33

(19)

4

Other income

(3)

(4)

(5)

(6)

(7)

Direct taxes paid

(5)

(8)

(12)

(15)

(17)

Others

(3)

2

(35)

-

-

Cash Flow from Operations

11

14

18

5

32

(Inc.)/Dec. in Fixed Assets

(1)

(2)

(9)

(7)

(4)

(Inc.)/Dec. in Investments

-

-

-

-

-

(Inc.)/Dec. in L.T.Loans & advances

-

-

-

(3)

-

Other income

3

4

5

6

7

Others

(1)

(2)

(0)

-

-

Cash Flow from Investing

1

(1)

(4)

(4)

3

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(3)

(1)

-

-

-

Dividend Paid (Incl. Tax)

-

-

(35)

(18)

(18)

Others

3

0

35

-

-

Cash Flow from Financing

(0)

(0)

(0)

(18)

(18)

Inc./(Dec.) in Cash

12

14

13

(16)

17

Opening Cash balances

21

33

47

60

44

Closing Cash balances

33

47

60

44

61

September 25, 2012

10

Initiating coverage | Disa India

Key Ratios

Y/E December

CY2009

CY2010

CY2011

CY2012E CY2013E

Valuation Ratio (x)

P/E (on FDEPS)

41.0

26.8

17.8

14.7

12.8

P/CEPS

41.0

26.8

17.8

14.7

12.8

P/BV

10.0

7.3

9.4

7.6

6.0

Dividend yield (%)

-

-

7.5

3.7

3.7

EV/Sales

5.2

3.3

2.2

2.0

1.7

EV/EBITDA

25.2

17.0

10.8

9.0

7.5

EV / Total Assets

9.0

6.4

7.9

6.7

5.1

Per Share Data (`)

EPS (Basic)

65.3

100.1

150.1

182.4

209.6

EPS (fully diluted)

65.3

100.1

150.1

182.4

209.6

Cash EPS

78.5

112.0

164.6

204.7

234.1

DPS

-

-

200.0

100.0

100.0

Book Value

268.1

368.1

285.8

352.1

445.5

Dupont Analysis

EBIT margin

17.9

17.9

19.3

20.8

20.7

Tax retention ratio

0.6

0.6

0.7

0.7

0.7

Asset turnover (x)

1.9

2.2

3.1

3.6

3.4

ROIC (Post-tax)

21.6

25.8

39.1

49.1

45.2

Cost of Debt (Post Tax)

9.5

44.1

-

-

-

Leverage (x)

(0.7)

(0.8)

(1.1)

(1.1)

(0.9)

Operating ROE

49.5

87.7

78.1

98.2

90.4

Returns (%)

ROCE (Pre-tax)

33.5

39.8

59.8

75.6

69.5

Angel ROIC (Pre-tax)

116.3

226.2

-

-

570.0

ROE

24.3

27.1

52.5

51.8

47.0

Turnover ratios (x)

Asset Turnover (Gross Block)

2.1

3.2

4.0

3.8

3.8

Inventory / Sales (days)

83

49

56

60

55

Receivables (days)

22

31

25

25

25

Payables (days)

175

140

191

191

191

WC cycle (ex-cash) (days)

(9)

(13)

(48)

(56)

(34)

Solvency ratios (x)

Net debt to equity

(0.8)

(0.8)

(1.4)

(0.8)

(0.9)

Net debt to EBITDA

(2.2)

(2.2)

(1.9)

(1.1)

(1.3)

Interest Coverage (EBIT / Interest)

38.6

113.6

129.1

138.9

138.8

September 25, 2012

11

Initiating coverage | Disa India

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Disa India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

September 25, 2012

12

Initiating coverage | Disa India

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Bhavesh Chauhan

Sr. Analyst (Metals & Mining)

Sharan Lillaney

Analyst (Mid-cap)

V Srinivasan

Analyst (Cement, Power, FMCG)

Yaresh Kothari

Analyst (Automobile)

Nitin Arora

Analyst (Infra)

Ankita Somani

Analyst (IT, Telecom)

Varun Varma

Analyst (Banking)

Saurabh Taparia

Analyst (Banking)

Rahul Kaul

Analyst (Cap Goods, Real Estate)

Bhupali Gursale

Economist

Vinay Rachh

Research Associate

Amit Patil

Research Associate

Shareen Batatawala

Research Associate

Twinkle Gosar

Research Associate

Tejashwini Kumari

Research Associate

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Sameet Chavan

Technical Analyst

Sacchitanand Uttekar

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Hiten Sampat

Sr. A.V.P- Institution sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Akshay Shah

Sr. Executive

Production Team:

Tejas Vahalia

Research Editor

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

September 25, 2012

13